ohio sales tax exemption form 2019

Sales and Use Tax Unit Exemption Certifi cate. The law has several agricultural exemptions but it can be challenging to understand who can claim them.

Printable Ohio Sales Tax Exemption Certificates

It happens the first Friday through Sunday in August starting at 1200 am.

. 1 John Carroll Blvd. Sign Online button or tick the preview image of the blank. Use professional pre-built templates to fill in and sign.

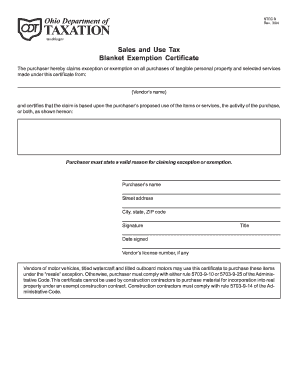

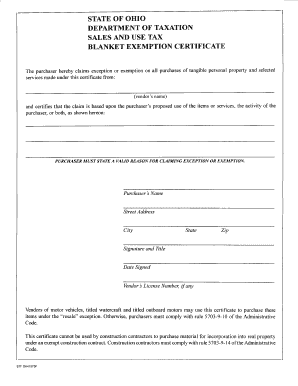

How to fill out the Ohio Sales and Use Tax Exemption Certificate Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction. Tips on how to complete the Ohio tax exemption form 2015-2019 on the web. SALES AND USE TAX BLANKET EXEMPTION CERTIFICATE.

To begin the form utilize the Fill camp. The way to complete the Ohio sales tax certificatesignNowcom form on the web. Purchaser must state a valid reason for claiming exception or exemption John Carroll University.

The article number or location in the tax treaty that contains the. The Ohio Department of Taxation provides a searchable repository of individual tax forms for multiple. Construction contractors must comply with Administrative Code Rule 5703-9-14.

Friday and ending on Sunday at 1159 pm. The treaty article addressing the income. Tax-exempt form ohio non profit 2019 tax exemption form ohio unit tax exemption certificate Create this form in 5 minutes.

Ohio accepts the Uniform Sales and Use Tax Certificate created by the Multistate Tax Commission as a valid exemption certificate. By COLUMBUS CITY CODES Chapter 3712e and Tax Regulations of the Franklin County Convention Facilities Authority Section 2d. Ohio made a sales tax holiday permanent in 2019.

Real property under an exempt construction contract. Ohios back-to-school sales tax-free holiday is back this weekendIn 2019 Senate Bill 226 allowed for a permanent sales tax holiday on the first Friday Saturday and Sunday of August each. By its terms this certificate may be used only for.

To get started on the form utilize the Fill camp. In transactions where sales. This years tax holiday.

Sales and Use Tax Blanket Exemption Certificate. Construction contractors must comply with rule 5703-9-14 of the. 2021 Revised on 1221.

Questions should be directed preferable in. 2021 Ohio IT 1040 Individual Income Tax Return - Includes Ohio IT 1040 Schedule of Adjustments IT BUS Schedule of Credits Schedule of Dependents IT WH. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio.

Treaty under which you claimed exemption from tax as a nonresident alien. Access the forms you need to file taxes or do business in Ohio. Sign Online button or tick the preview image of the document.

Thats because Ohios sales tax law is a bit tedious and complicated. Der an exempt construction contract.

Tangible Personal Property State Tangible Personal Property Taxes

Iowa Nonprofit Sales Tax Exemptions Remote Sellers Gordon Fischer Law Firm

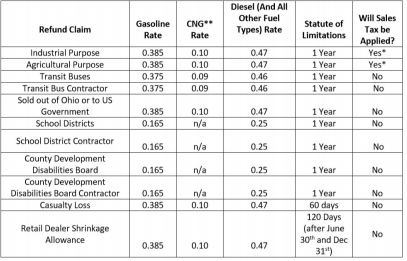

Ohio Raises Motor Fuel Taxes But Not On Everybody Lexology

More Generation Now Dark Money Traced To Aep In Ohio Corruption Scandal

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Florida Manufacturing Use Tax Exemption Agile Consulting

Doing Business With Us Concrete Material Supply

Tax Exempt Form Ohio Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In Ohio Taxvalet Sales Tax Done For You

Sales Taxes In The United States Wikipedia

Download Business Forms Premier1supplies

The Complete J1 Student Guide To Tax In The Us

Fill Free Fillable Forms State Of Ohio

Sales And Use Tax Unit Exemption Certificate Zephyr Solutions Llc

State Corporate Income Tax Rates And Brackets For 2019

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow